The Definitive Guide for Property By Helander Llc

Wiki Article

Some Ideas on Property By Helander Llc You Should Know

Table of ContentsSome Known Questions About Property By Helander Llc.See This Report on Property By Helander LlcThe Facts About Property By Helander Llc RevealedUnknown Facts About Property By Helander LlcProperty By Helander Llc Things To Know Before You BuyIndicators on Property By Helander Llc You Should Know

The benefits of purchasing realty are countless. With appropriate assets, capitalists can enjoy foreseeable cash circulation, excellent returns, tax advantages, and diversificationand it's feasible to utilize property to build wealth. Thinking of spending in real estate? Here's what you need to learn about realty advantages and why realty is considered a good investment.The advantages of investing in real estate include easy revenue, steady cash circulation, tax advantages, diversification, and take advantage of. Real estate financial investment trust funds (REITs) provide a means to invest in actual estate without having to own, operate, or financing homes.

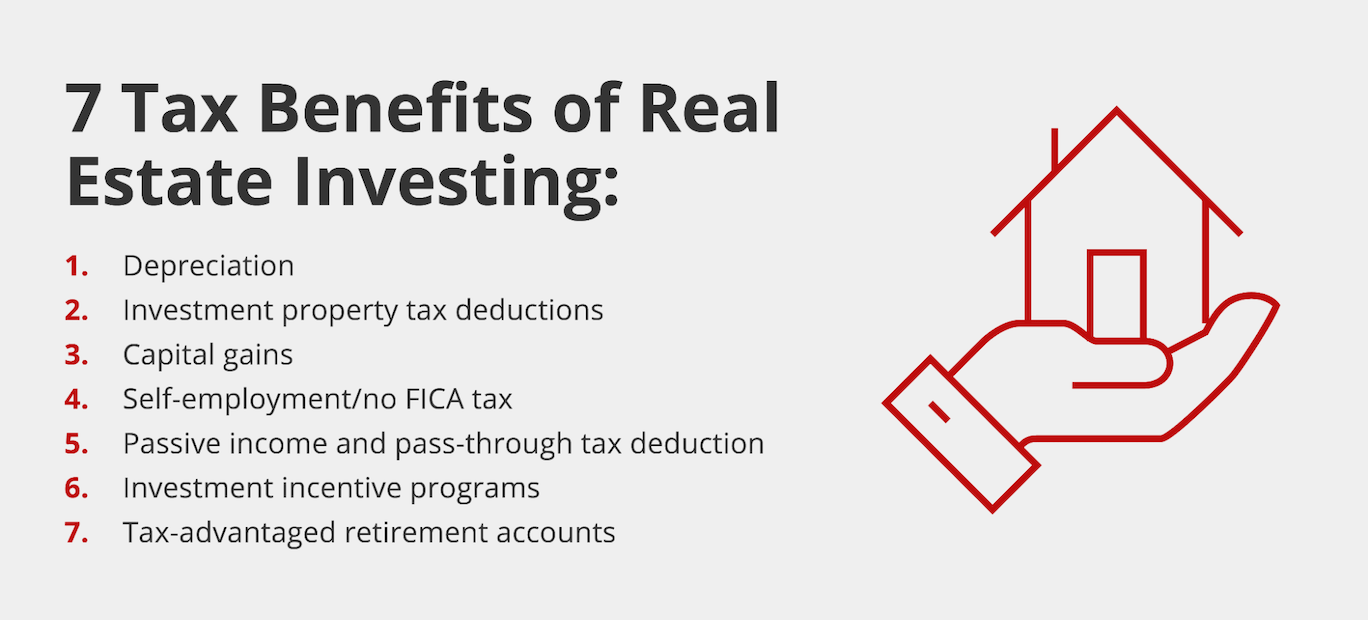

In numerous cases, capital only reinforces gradually as you pay down your mortgageand accumulate your equity. Investor can capitalize on countless tax obligation breaks and deductions that can conserve cash at tax time. As a whole, you can subtract the reasonable expenses of owning, operating, and managing a home.

Unknown Facts About Property By Helander Llc

Genuine estate worths have a tendency to enhance over time, and with a good financial investment, you can transform a revenue when it's time to offer. As you pay down a building mortgage, you construct equityan possession that's part of your net well worth. And as you develop equity, you have the take advantage of to get more residential or commercial properties and enhance cash flow and wide range even much more.

Because realty is a tangible property and one that can act as security, funding is easily offered. Actual estate returns differ, depending upon variables such as area, asset class, and administration. Still, a number that lots of capitalists intend for is to defeat the ordinary returns of the S&P 500what several individuals describe when they state, "the marketplace." The rising cost of living hedging ability of property originates from the favorable partnership in between GDP growth and the need genuine estate.

The Of Property By Helander Llc

This, subsequently, translates right into higher resources values. Therefore, realty tends to keep the purchasing power of resources by passing a few of the inflationary pressure on renters and by including several of the inflationary stress in the type of funding admiration. Home loan borrowing discrimination is unlawful. If you think you've been victimized based upon race, religion, sex, marital standing, use of public assistance, national beginning, special needs, or age, there are actions you can take.Indirect genuine estate spending involves no direct possession of a building or residential or commercial properties. There are several ways that possessing genuine estate can protect versus inflation.

Ultimately, buildings financed with a fixed-rate loan will see the family member quantity of the month-to-month home mortgage repayments tip over time-- for instance $1,000 a month as a set repayment will certainly become less burdensome as inflation wears down the purchasing power of that $1,000. Usually, a primary house is ruled out to be a realty financial investment given that it is utilized as one's home

Little Known Questions About Property By Helander Llc.

Despite the assistance of a broker, it can take a few weeks of work simply to find the ideal counterparty. Still, realty is an unique property class that's easy to understand and can boost the risk-and-return profile of a capitalist's portfolio. On its own, realty uses cash circulation, tax breaks, equity building, affordable risk-adjusted returns, and a hedge versus rising cost of living.

Buying realty can be an incredibly rewarding and profitable endeavor, however if you're like a whole lot of new financiers, you might be asking yourself WHY you must be purchasing actual estate and what benefits it brings over various other investment chances. In enhancement to all the incredible advantages that go along with spending in genuine estate, there are some downsides you need to think about as well.

Facts About Property By Helander Llc Uncovered

If you're looking for a way to buy right into the realty market without having to spend numerous hundreds of bucks, examine out our homes. At BuyProperly, we make use of a fractional ownership version that useful site allows investors to begin with just $2500. Another major advantage of real estate investing is the capability to make a high return from buying, remodeling, and re-selling (a.k.a.

The smart Trick of Property By Helander Llc That Nobody is Discussing

If you are charging $2,000 rent per month and you sustained $1,500 in tax-deductible expenditures per month, you will just be paying tax on that $500 revenue per month (Sandpoint Idaho real estate). That's a huge distinction from paying tax obligations on $2,000 each month. The earnings that you make on your rental device for the year is thought about rental income and will be tired accordinglyReport this wiki page